Image taken at Luna Liquida Hotel, Puerto Vallarta

I am married to a doomsday prepper. Our basement is filled with vats of powdered emergency food stuffs, oxygen bags, industrial outdoor gear, large plastic containers of water, hazmat suits, and more. There’s even an ice pick hanging on the wall, which he used for mountaineering with a friend, but I’m pretty sure that it’s part of his apocalypse arsenal. He’s researched generators and studied blueprints for bunkers. At one point he ordered numerous books on urban farming and off-the-grid how-to manuals in case the internet ceased to exist. This survivalist mentality started decades before the pandemic was even a sniffle in our collective nostrils.

It’s hard to explain, but this quality is both disturbing and endearing to me. I don’t subscribe to the intense fear that drives prepper-ism, but I’m a planner by nature so I get it.

In fact, I’ve been doing my own doomsday prepping these days. My particular doomsday is tied to K’s imminent transition from high school to college. In the fall, she’ll be flying from the Pacific Northwest coop and going to the Midwest — Chicago to be exact — which feels so far from Seattle. My identity is unapologetically ensconced in motherhood, and since she is my one and only child, things are about to get funky for me.

My new identity will be as an empty nester. It’s interesting: K reported that according to her psychology teacher, empty nesters are the happiest people. I’m willing to consider that as a possibility, but I’ll have to go through a stage of deep grief first. For the last almost eighteen years, I have been perpetually tracking and managing her schedule, strategizing what to feed her, analyzing her needs and wants. There will be a giant hole in my brain and heart when the tracking and strategizing and analyzing become unavailable and obsolete.

How am I prepping? For one, I’ve been doing a lot of contemplating about who I am and who I want to be without mothering at the forefront. Sure, I’m a wife and daughter and sister and friend and creator of books and sewing projects and such, and these will continue to be important roles. And it’s not as if I won’t have any maternal duties once K is off to college. I don’t have definitive answers yet, of course, but I’ve been dreading/enjoying the contemplation. I also often wonder whether I’ve equipped my daughter with sufficient life skills. And I worry that I’ve saddled her with my neuroses. Only time will tell.

I’ve been continuing to purge as well. As I’ve mentioned M and I may or may not move when she leaves, but I’m preparing nonetheless. K and I went through the bins with her childhood toys and stuffed animals and clothes. Oh, the clothes! Remember the hundreds and hundreds of garments I sewed? We’ve kept only a handful. I am ridding the collection of cookie cutters from the days when I used to make cute pancake shapes (insane, now that I think about it). We have dozens of volleyballs from all the camps and teams she participated in. Do we keep any? A deluge of emotions…and at the same time, liberating.

How could she have been so little! And oh, she was clearly meant to be a musician…

I’m in the thick of prepping, and I may have more to say later but for now I’m going to make a list of all the other items to tackle: K’s schoolwork from kindergarten to high school; her music paraphernalia (what should we do with her piano?); her room! Will I finally stop sewing in my bedroom and use her room as a studio? Or maybe it would be a moot point if M and I move. He hasn’t quite let go of the mobile home idea, but is keenly interested in boat-living now. I’m not on board, pun intended. Not the least of which because I get seasick.

Anyway. Empty nest prepping. It’s happening. If you’ve gone through it, I welcome any words of wisdom and anecdotes of the experience!

Empty nests and flying the coop reminded me: have you ever seen a peacock take flight? It’s startling and not as graceful as I expected. Quite shocking in its blustery-ness, to be honest. I guess all those feathers are somewhat cumbersome…

In other news:

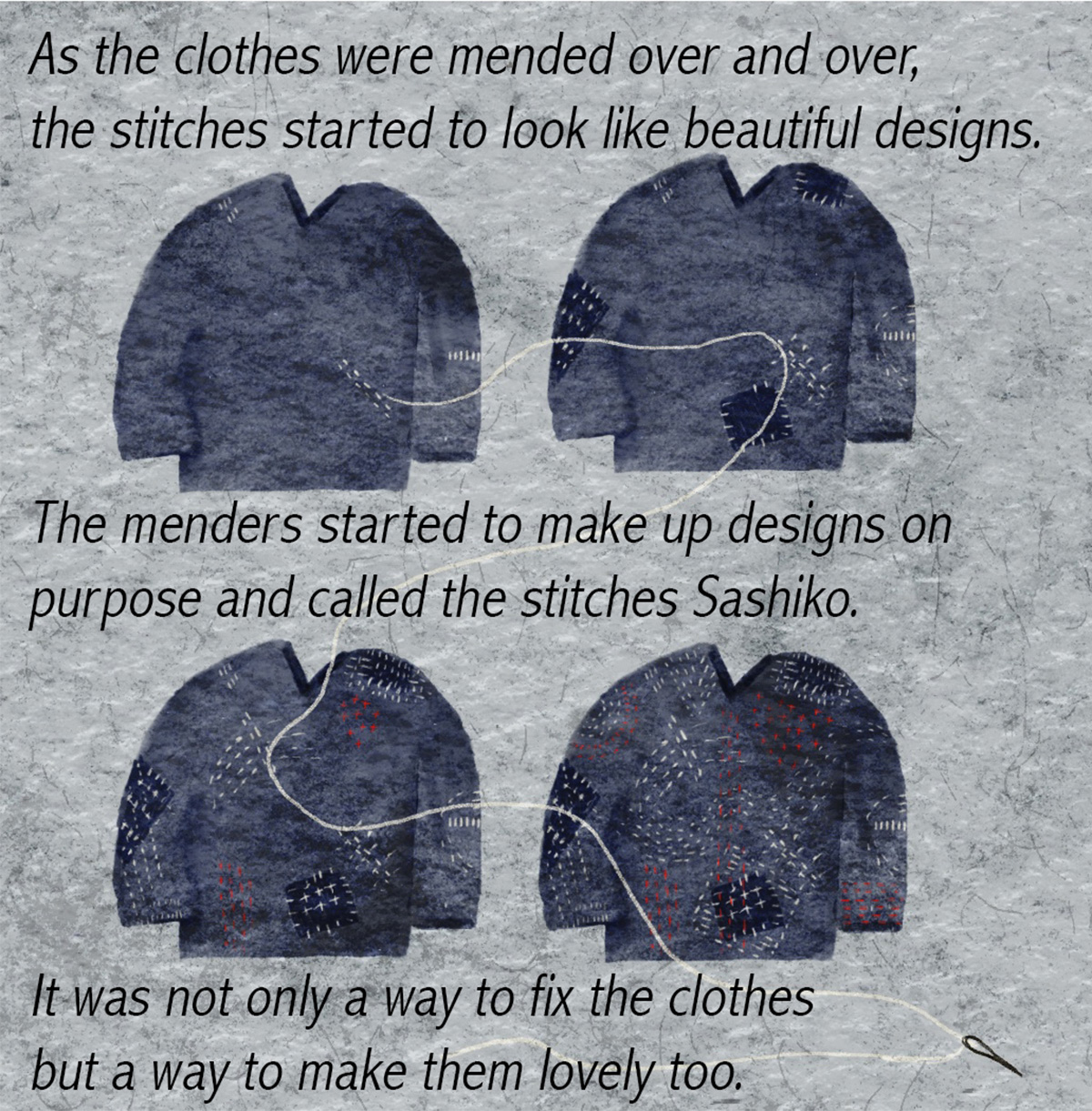

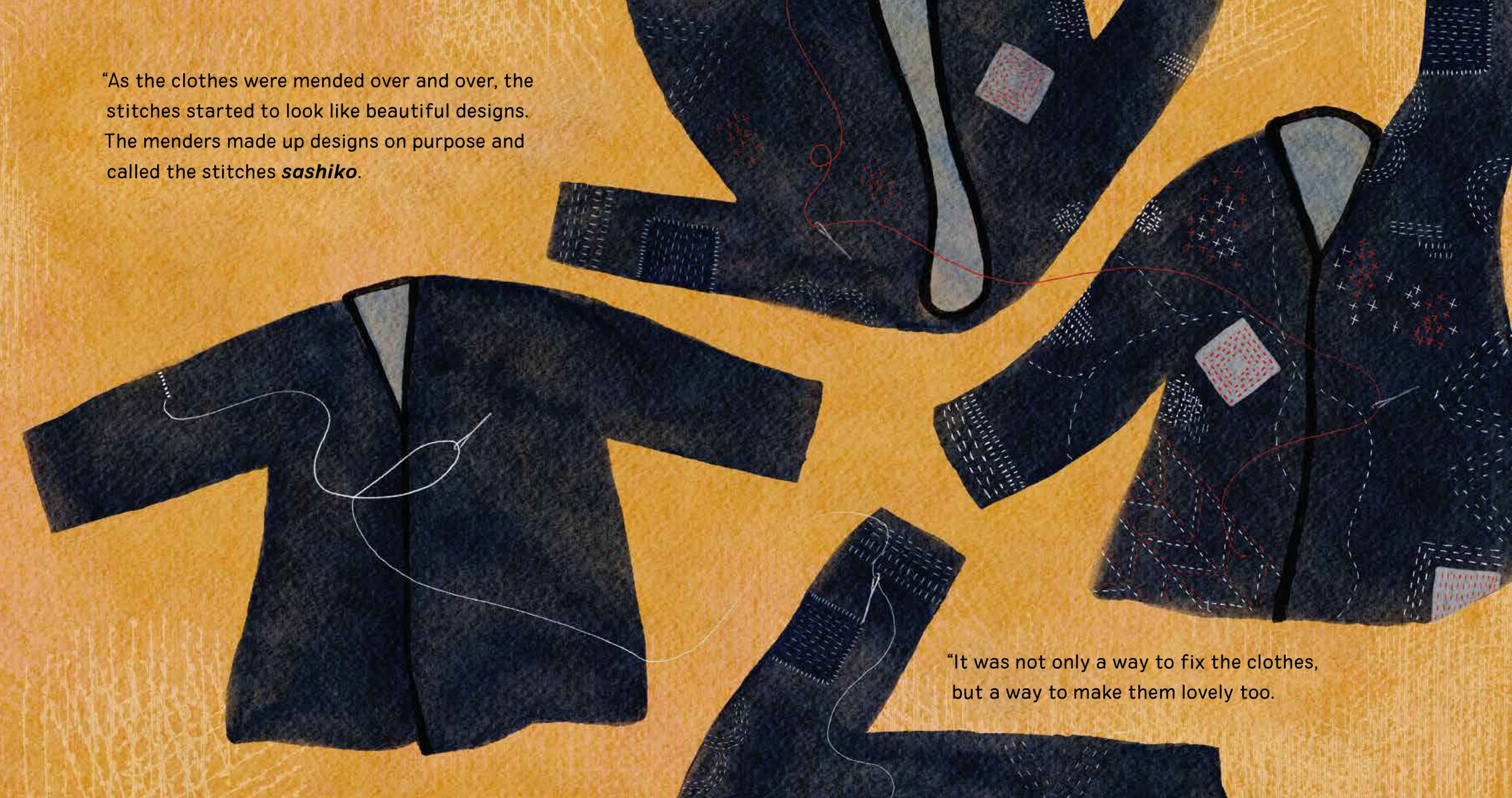

- Sashiko’s. Stitches releases on April 2nd!! Pre-orders are available wherever books are sold. I’ll share some behind the scenes next time.

- I’m starting on a new book, so I will be in focus mode for the next few months. I may not be on social media much, not that I’m too active regularly.

- I’m still de-stashing my ample fabric hoard and am sewing, sewing, sewing (okay, mostly planning on sewing, but some sewing is definitely going on). I’ll try to share as much as I can in the next month or two.

That’s it for now! Hope you’re having a lovely, lovely end of February (a leap year, which makes it feel extra special)!! It’s almost spring here, can you believe it?

This week I met up with a friend to catch up over delicious green tea, and we both marveled at what a blur this year has been. I can’t, for the life of me, remember much of it. There was the excitement of K’s launch of her first

This week I met up with a friend to catch up over delicious green tea, and we both marveled at what a blur this year has been. I can’t, for the life of me, remember much of it. There was the excitement of K’s launch of her first

This is it, my friends. The final Advent Calendar for my not-so-little girl. Next year around this time, she’ll be somewhere on a college campus, taking exams or grabbing food from the dorm cafeteria on her way to a class. The daunting phrase is looming above me all the time lately: empty nester. I have a plethora of thoughts on that. But I won’t go into them right now.

This is it, my friends. The final Advent Calendar for my not-so-little girl. Next year around this time, she’ll be somewhere on a college campus, taking exams or grabbing food from the dorm cafeteria on her way to a class. The daunting phrase is looming above me all the time lately: empty nester. I have a plethora of thoughts on that. But I won’t go into them right now.

It’s a similar concept to

It’s a similar concept to